- David & Nicole Tepper increase Hurricane Helene relief commitment to $750k

- David & Nicole Tepper increase Hurricane Helene relief commitment to $750k

- McDowell County wildfire spreads to 500 acres, evacuation orders in place

- Evacuations in Caldwell County due to wildfire

- Northwest Houston 'ghost neighborhood' caused by repeated flooding to become latest detention basin

Insurance questions? What homeowners should know going into hurricane season

WILMINGTON, NC (WWAY) — June 1 marks the beginning of hurricane season, so now is the time to begin reviewing your insurance policies and make sure that you have enough of the right coverage.

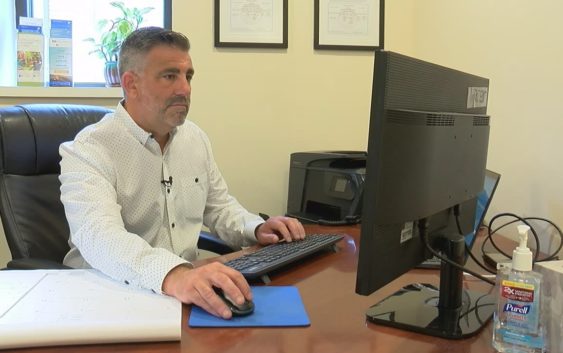

George Trifolo, owner and agent at Trifoli Insurance Group, says a good place to start is page one, where you’ll find your dwelling coverage. This is the amount of money you would get to replace your home if there was a total loss.

“The dwelling coverage may need to be increased because we recently had a surge in lumber prices,” Trifoli said. “So the cost to rebuild your home may be more than it was last year.”

This is not the tax value or market value of your home and does not include the land value. Trifoli explains that if your home is worth $500,000 you may not need to insure it for that much but you should make sure it has enough covered so there would be enough for it to be rebuilt.

The agent says everyone in the coastal counties of North Carolina has the same type of policy where the wind and hail is excluded or a policy where it is included but has a separate deductible.

“Some folks may be covered through the wind pool, where the wind and hail is covered through the state or they may have an all-inclusive policy but that policy will have a separate wind and hail deductIble,” Trifoli said.

On top of that, you may have a named storm deductible, which would kick in in the event of a named storm or hurricane. Additionally, you want to make sure all your policies are up to date.

“This year also a lot of people have gone through refinancing,” Trifoli said. “With a refinancing, you have a new mortgage company and a new escrow and that information needs to be updated on your insurance policy so that when your renewal comes, your agent and your insurance carrier know who to send the bill to.”

If this information is not kept up to date, it could lead to a lapse in coverage due to non-payment.

According to Trifoli, one of the most common types of damage he sees following a hurricane is roof damage. The average roof age is 15 to 20 years, so getting a new roof may not only be additional protection for your home, it could also result in a discount on your homeowner’s insurance.

More information that you should notify your insurance agent of is any additions you may have made to your home or other new personal property you have recently acquired.

Finally, flood insurance, which is not typically included in a homeowner’s policy.

“If you’re concerned, you’ve seen a lot of water coming up in your yard these last couple of storms, you can get a flood insurance policy for around $500 per year give or take,” Trifoli said.

Trifoli says if you are uncertain or just want to know more about your policy, call your agent and check up on your coverage.

To stay up to date on what’s happening in the tropics and what’s in store for our area this seaon, download the WWAY Stormtrack 3 weather app.